Insurance Companies Fighting Climate Change:

One Piece of the Puzzle

In major news outlets, much of the news around climate change focuses on initiatives spearheaded by governments and NGOs, or what individuals can do on a daily basis.

But there are many major institutions in between these extremes that are working to tackle climate change, and as major employers that also hold large investment portfolios, insurance carriers are among the largest companies fighting climate change and working to mitigate its impact.

This week, we’ll take a moment to address how we can measure corporate climate change initiatives and look at how a couple of our partners in the flood insurance industry are approaching this planet-changing issue.

Many Ways to Approach Corporate Climate Change Initiatives

It would be impossible to identify one path for all organizations to reduce their impact on the climate, in part because, as Professor Michael E. Porter told the Harvard Business Review, “Each company’s approach will depend on its particular business and should mesh with its overall strategy. For every company, the approach must include initiatives to mitigate climate-related costs and risks in its value chain.”

While value chains vary widely in scope, there are a few common, high-level things most organizations can do:

- Leverage your capital. Commit to green or net-zero investments and adopt a culture of transparency to hold your company accountable on this investment strategy. In the same vein, companies can partner with like-minded institutions to amplify their climate risk mitigation efforts.

- Leverage your reach: If you are a large American or multinational company, you have the power to communicate to a large network. You can make use of this reach to share your own best practices for reducing your carbon footprint and promote causes that further planetary wellbeing. (If this sounds broad, remember, so is your reach.)

- Challenge your organization to undergo a cultural reset: From the top down, leadership has the ability to raise risk awareness within your organization, and for all of us, the risks we face include those posed by climate change. How your company approaches climate change will impact the longevity of your organization and the lives of your customers – especially for those of us in the insurance industry. But whatever your field, your culture can make a difference in encouraging your people to engage with the huge challenge we all face on our warming planet.

If you read this list and thought, “My company doesn’t have a big carbon footprint compared to those in the oil and gas industry,” you aren’t wrong. In fact, it’s important to recognize that some companies contribute more to climate change than others as you look at where your company stands in carbon emissions.

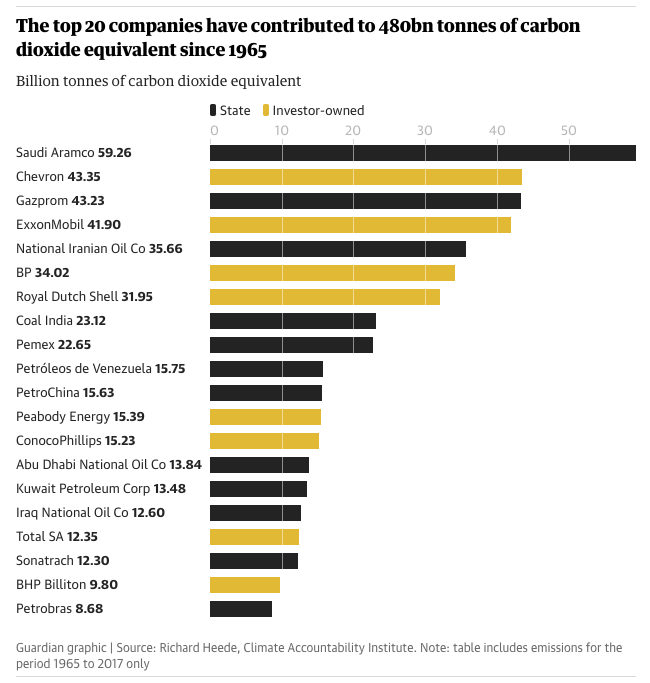

In 2019, the Guardian reported on work by the Climate Accountability Institute that identified 20 fossil fuel companies whose work “can be directly linked to more than one-third of all greenhouse gas emissions in the modern era.”

But it’s all too easy to compare your impact to megaproducers and diminish the importance of your own efforts.

In the face of this type of ranking, it may seem futile for any major organization outside of this group to start up a sustainability working group or to decide to eliminate single-use plastic at headquarters. However, there is tremendous value in these types of measures, both in measurable waste reduction and promoting a climate-forward cultural mindset shift for your company.

The Farmer’s Corporate Approach to Disaster Resilience

If you were to read the whole Farmers’ Corporate Responsibility site, you’d see that they have an initiative to become a completely plastic-free enterprise, their staff logs an admirable number of volunteer hours, and these folks donate hundreds of thousands of dollars to charitable causes. But their approach to working on a disaster resilience model is what sets them apart.

The Farmers’ approach has three pillars, which are illustrated in the graphic above:

- Help communities prepare for the next disaster by sharing best practices, safety information, and educational materials proactively.

- Help communities endure disasters by providing immediate and experienced responses and by supporting first responders.

- Help build (and rebuild) more sustainable and resilient communities in the face of increased extreme weather.

Farmers doesn’t just try to be more “environmentally focused” on the organization level. They are also looking at the way their agents can promote better disaster preparedness through community education around flood risk and the importance of flood insurance.

Their internal focus on agent education helps ensure that their teams are prepared to talk to homeowners about their flood preparedness beyond just what their flood risk is according to the most recent map. And this level of commitment can make a tremendous difference for individuals and entire communities.

To find out how National Flood Services can help support your agent training efforts, check out our agent resource library.

How Allstate Promotes Sustainable Practices with a Holistic Climate Strategy

If you’re looking for a best-in-class example of corporate sustainability, look no further than Allstate’s Sustainability Report, which includes information on how they’re using renewable energy to powered headquarters, transitioning its fleet to hybrid vehicles, and investing in green energy to power a less fossil-fuel dependent future.

Allstate’s commitment to disaster resiliency was recently recognized by the Carbon Disclosure Project (CDP) for its climate impact initiatives. Making the CDP’s A-list is a significant honor for any organization, and it takes more than just about reducing your carbon footprint.

How did Allstate get there? A strategic, organization-wide effort to…

- Reduce internal emissions for company operations and around supplier relationships.

- Increase transparency in your regulatory measures and reporting around climate change.

- Adopt investment and underwriting practices that drive climate change progress by adopting environmental, social, and governance (ESG) factors and service offerings that support climate action.

These measures are a sterling example of what insurers can do to help reduce the risk of climate change for their organization and for those they insure. For insurers, it’s imperative that this plan involves building climate resiliency into your investment strategy and business model. Allstate, laudably, is leading the industry on this front.

Insurance Carriers Can No Longer Ignore the Risks of Climate Change

Although different industries contributed different amounts of carbon to the climate equation, no industry will escape the impacts of climate change over the next century, and insurers are uniquely positioned in this fight to guide their companies and clients toward a safer future by taking strategic steps to shape their climate resilience plans today.

If you want to know how Trident technology or the National Flood Services team can support your plan to prepare agents and customers for a future with increased flooding, visit our Carrier Portal today.

Blog Articles