Why an Incomplete Picture of Flood Risk Makes

Marginalized Communities More Vulnerable to Flooding

Recent flood risk calculations have shown that millions more American property owners are at risk than FEMA flood maps indicate, and climate change is amplifying that risk. This has major implications for lower-income and marginalized communities, who often go without coverage only to be faced with devastating flood damage and financial losses.

And this isn’t just a risk after a hurricane makes landfall. In 2021, a heavy rainstorm could be devastating to those who aren’t familiar with the risk of inland flooding and don’t understand the importance of maintaining flood insurance coverage.

With Risk Rating 2.0, which is scheduled to roll out in October 2021, better risk assessment is the first step toward better infrastructural investment and protection. But you don’t have to wait until then to get a better sense of flood risk near you.

Locating the Holes in Today’s Flood Maps

It’s long been suspected that Americans are underprepared for floods and don’t understand their flood risk, but it can be hard to pin down where the discrepancies are located.

In June of 2019, the First Street Foundation released new flood risk data that demonstrated that property owners in the U.S. grossly underestimate their flood risk. Media outlets were quick to disseminate relevant map updates in local publications, but as Quartz reported, “The 14.6 million homes the maps show are exposed to a major ‘100-year’ flood is nearly twice the official estimate.”

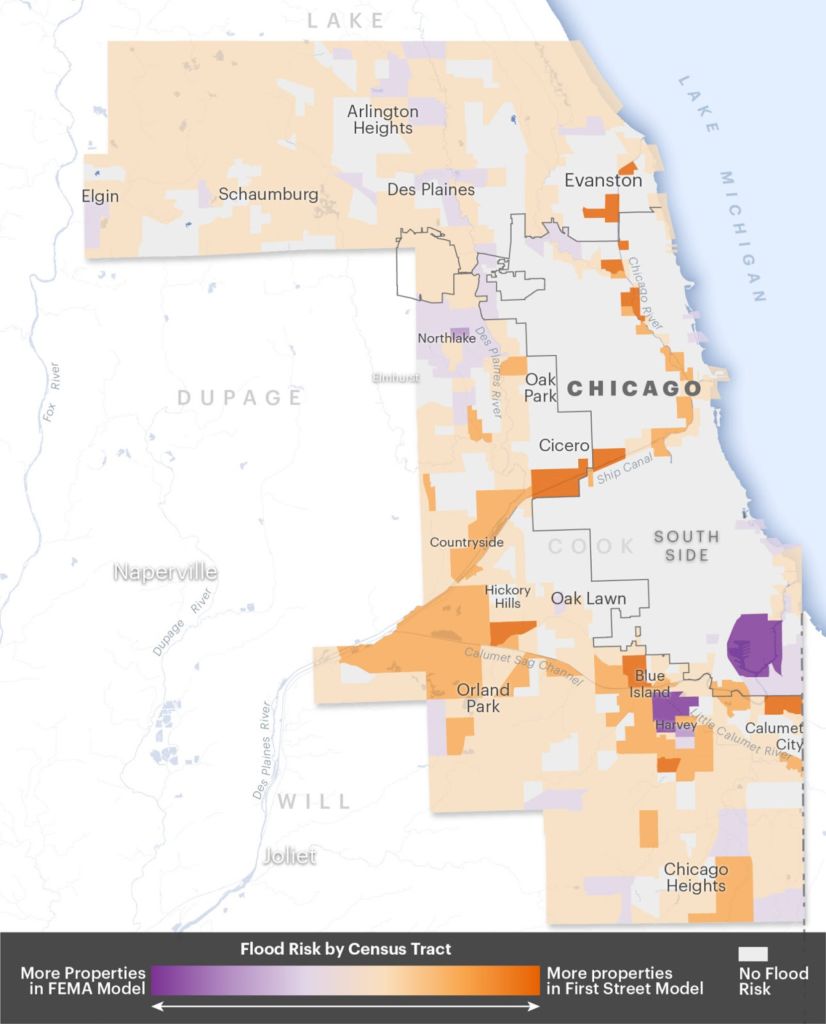

And as journalists were quick to point out, the hidden flood risks uncovered by First Street’s maps don’t point to the most obvious waterfront. In Chicago, for example, the highest risk areas are along the banks of the Chicago River rather than the shores of Lake Michigan.

Data source: First Street Foundation, FEMA Map: Jeremy Goldsmith, special to ProPublica

This trend bears out across the center of the country, where homeowners in the Mississippi and Missouri River watersheds are at much higher risk than they were in the past as the powerful rivers are pulling more water into the local ecosystem than in past decades.

Throughout the country, the data from First Street highlights the risk of inland flooding and the dangers a heavy rainfall can pose miles from the nearest water source, where homeowners are least likely to think the cost of a monthly flood insurance premium is a wise investment.

Why Inequity Grows alongside the Risks of Climate Change

Given that the map of flood risk shows a patchwork of underestimates, what does this say about inequality?

As Richard Matthews explains, “Low-income communities and people of color tend to have considerably less access to resources, such as insurance, to help them recover from floods.”

In addition, these groups often have a complex matrix of complicating factors, including:

- Poor access to emergency response information

- Limited savings to cover unexpected costs

- Lower job security

- Higher health impacts as result of flooding

For those without a safety net, it can also be difficult to access relief funds, especially in situations in which homeowners are unable to return to their permanent address for a long period of time.

After Super Storm Sandy, Vox reported that “New York City officials warned that skyrocketing flood insurance premiums could trigger a foreclosure crisis.” As homeowners in newly high risk areas struggle to recover from a natural disaster, the financial burden of recovery too often compounds as they try to reestablish themselves with appropriate flood insurance coverage.

This is where FEMA can assist and where the National Flood Insurance Program aims to address concerns about the affordability of coverage as they launch their new risk rating system.

The Good News: Flood Risk Assessment Reform Is on the Way

Given the number of unpredictable forces at play during the ongoing pandemic, we may yet see another delay in the rollout of Risk Rating 2.0, but that doesn’t mean that the technology behind flood mapping won’t continue to improve.

This same technology is improving flood management and flood risk assessment, which are both readily available for homeowners around the country.

While there’s much we still don’t know about Risk Rating 2.0 will make the NFIP operate more like a private insurer. And that’s why updating flood maps to more accurately reflect current and evolving risk levels matters.

In the meantime, some risks are increasingly predictable and homeowners aren’t on their own when. As Zillow reported, “By 2050, more than 386,000 existing homes in U.S. coastal areas are likely to be at risk of permanent inundation from sea level rise alone or of chronic flooding from sea level rise plus tides and storm surges.”

The real estate site now offers a tool to calculate the risk of flooding in your area, but you can also get started with a flood insurance agent today.

More Nuanced Flood Maps Will Help Protect Homeowners

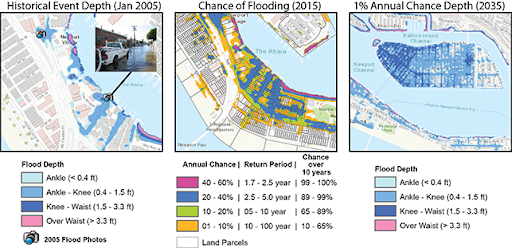

An example of what finder-grained flood maps can look like today. Source: Brett Sanders/UCI

Flood risk isn’t static, but the old flood maps are. As the climate changes, every single degree fahrenheit increase in the ocean’s temperature allows the atmosphere to hold four percent more water vapor. This means that when weather patterns lead to heavy rainfall, downpours may be stronger and longer than in the past, in places where people who aren’t checking their flood risk would ever expect to suffer flood damage.

To ensure you’re protected, get a quote for flood insurance coverage today.

Blog Articles