Taurus Flood-National Flood Services (Taurus Flood), a leading provider of flood and insurance technology solutions, announced that it has been awarded the Cypress Property & Casualty Insurance Company flood insurance service provider contract.

In their interview with Intelligent Insurer, Lindsey Erickson and Thomas Garner stress the importance of educating Florida insurers on flood insurance and the need for carriers to offer it alongside property policies.

PropertyCasualty360 discusses the storm that created claims complexities because of new statutory reforms, homeowners with flood insurance, and supply chain and worker shortages – featuring Cynthia DiVincenti.

FEMA’s Risk Rating 2.0 modernizes the current risk rating methodology used by the National Flood Insurance Program. Property Casualty 360 highlights key points agents will want to communicate to their policyholders about what changed on October 1st.

Money Magazine discusses hurricane season, flood insurance, and Risk Rating 2.0 with National Flood Services CEO Lindsey Erickson.

National Flood Services, a leading flood insurance solution provider and National Flood Insurance Program (NFIP) partner, today announced the appointment of Lindsey Erickson as its Chief Executive Officer. Lindsey replaces interim CEO George Ruhana, who will continue in his role as operating partner.

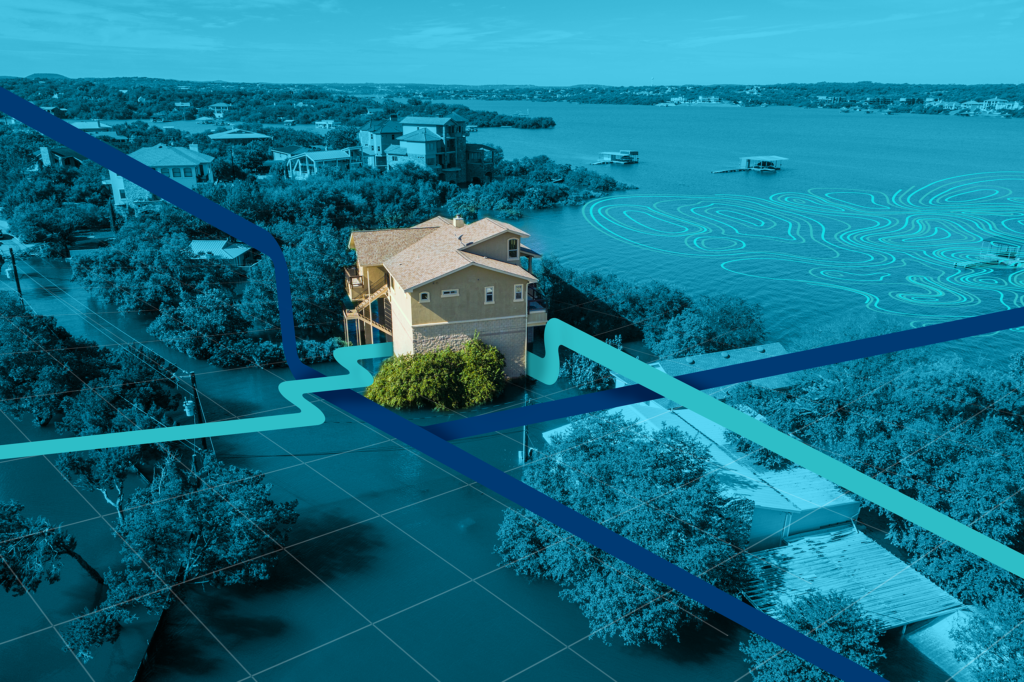

Flood insurance is not required for homeowners unless they live in a high-risk flood zone. However, the majority of homeowners who experienced flooding in 2020 did not live in flood zones and were not covered under their homeowners insurance. According to FEMA, 30% of all flood damage claims happens in low to moderate-risk zones, where flood insurance is not required.

The flood insurance market is awash with opportunity. Just 5% of single-family homeowners in the US have flood insurance, according to management consulting firm Milliman, yet flooding is the top peril facing Americans. In fact, new research from First Street Foundation has revealed that 70% of homeowners are at risk of flooding that isn’t reflected in current Federal Emergency Management Agency (FEMA) flood maps.

National Flood Services, a leading provider of flood insurance solutions in the United States, today announced that it has been awarded the National Flood Insurance Program (NFIP) Direct service provider contract. NFIP Direct facilitates the issuance and administration of NFIP insurance policies on behalf of the Federal Emergency Management Agency (FEMA), an agency of the Department of Homeland Security.

“It is a necessity for homeowners to understand how—or if—flood damage is covered under their current policies, especially with the changes in today’s climate,” says Ralph Blust, CEO of National Flood Services.

Insurers and brokers can respond efficiently to Hurricane Laura claims and other disasters by using remote adjusting. And National Flood Services proved it this spring.

Trident is a new policy, claims and reporting platform that modernizes the way flood is purchased, underwritten, managed and serviced. Trident modernizes every aspect of the flood insurance experience for policyholders, agents, write-your-owns (WYOs), claims examiners and back-office operations staff. By combining these processes into a single application, Trident makes it easier for agents to protect their customers from flood risk.

We are now in the heat of the hurricane season, so there are a lot more property owners, brokers, and insurance professionals who are thinking about and worried about flooding. Yet, as discussed in this episode, everyone is in a flood zone. You can live in a desert or upon a hill, like Ellicott City, MD, and be exposed to major and catastrophic flooding. In this episode, I spoke with Rick Tighe of NFS (National Flood Service) about their mission and how they are using technology to expand the take-up rate by property owners.

Our latest forecast is for a total of 20 named storms. Out of those 20, nine will become hurricanes and, of those nine, four will become Category 3, 4 or 5 hurricanes on the Saffir-Simpson scale,” said Dr. Phil Klotzbach, research scientist at Colorado State University, during a webinar hosted by National Flood Services (NFS) entitled, “2020 Hurricane Season Forecast from the Experts at Colorado State University.

Sixty-two percent of homeowners say they’re prepared for a flood, but only 12 percent have flood insurance, according to a new survey conducted by the Harris Poll on behalf of National Flood Services, a leading flood insurance solution provider that processes 1.8 million flood policies and $1.4 billion of National Flood Insurance Program (NFIP) premiums a year.

“Disaster assistance isn’t a given, and property owners should not rely on it. It isn’t always made available, and when it is, it could be just a loan they’re going to have to repay.” -Cynthia DiVincenti Director and Vice President of Government Relations National Flood Services

COVID-19 has created financial hardships for many Americans. This in turn means that people might not be willing or able to spend an additional amount of money on a flood insurance policy right now because they financially can’t manage it. As a result, noted Courtney Guss, director of training and agent development at NFS, which is the leading provider of flood solutions in the US, “You have people who should be insured who maybe are not purchasing policies, and then people who are currently insured not renewing policies at a much larger rate.”

The flood insurance market has historically lagged behind other lines of business when it comes to customer simplicity, agent experience, and innovation. There has been limited progress in terms of operations and workflows within companies, the way in which agents are educated, and how the product is sold. However, one flood solutions provider that boasts a 35-year history and deep expertise in this marketplace is driving innovation and modernization into the flood insurance industry.

NFS has modernized the flood insurance space with its recent launch of Trident. The new technology provides a cloud-based platform that revamps the flood experience for policyholders, agents, write-your-owns (WYOs), claims examiners, and back-office operations staff.

Flooding is the most common and costly natural disaster in the US, yet property owners across the country remain severely underinsured. Rising sea levels, intense weather events and other effects of climate change are driving home the importance of appropriate flood insurance.

As insurance agents know, the start of spring is also the start of flood season. In the coming months, your customers will face an increased risk for flooding—and if the last few years are any indication, some of that flooding could be severe, according to the National Weather Service. More generally, changing weather patterns year-round are making flood damage more common.

At National Flood Services, they’re used to dealing with emergency situations, so the Kalispell company is leading the valley’s charge to stop the spread of coronavirus. To keep the staff and clients safe from the current threat of COVID-19, the company jumped on the bandwagon early in January to implement new operations aimed at avoiding the virus.

A cloud-based flood processing application, Trident brings together every aspect of flood insurance — from purchasing and underwriting to management and servicing — into a single, seamless application.