3 Lessons Learned from 35 Years on

the Frontlines of Disaster Recovery

Robert Butler, Director of National Flood Services, has been in this industry for longer than our organization has existed. So, when we wanted to reflect back on what’s changed in our 35 years on the frontlines, there was no better candidate for a phone call.

Robert got his start by spending nearly 30 years in the private insurance market, gaining experience in flood insurance and underwriting, which later served him well in roles inside FEMA and on the other side of several private-public partnerships.

We sat down with him to ask a few questions about the three biggest things he’s learned along the way. Here are the three biggest changes he’s observed.

1. Agent Education on Flood Insurance: From Optional to Required

In 2003, Hurricane Isabel arrived in Washington’s backyard, severely impacting Maryland and Virginia. At the time, Many people didn’t understand how their flood insurance coverage applied at time of loss and too many found that their agents weren’t very helpful either.

Map of Hurricane Isabel’s landfall. Source: Weather.gov

This local storm damage provided FEMA’s leadership with an “aha moment:” they saw a clear need to educate agents on the flood insurance product, its availability, and what it covers.

The result was the Flood Insurance Reform Act of 2004, which requires agents who sell flood insurance to get continuing education credits on the state level every year to confirm to FEMA that they’d be able to appropriately educate homeowners.

This act was a great opportunity to bolster the flood insurance program and boost awareness in the insurance industry and among homeowners. Once better flood education for insurance agents became available, rates of insured homeowners also rose.

This sea change began in earnest back in 2004, but it’s one we continue to promote as a mainstay of the National Flood Services mission today. Our educational video library is an excellent resource, and we hope that our sales toolkit continually provides the information agents need

2: From Slide Rules to Risk Rating 2.0: Automating Flood Risk and Rate Assessments

Back when I first started, we had a slide rule rater. Everything has evolved with the advent of the internet, but automating rating policies has made it easier for agents to quote the policy at their home office during this pandemic.

Rate calculations went digital for flood insurers in the late nineties, and a big piece of that was the digitization of flood maps. Before Google Maps was a ubiquitous tool everyone carried around in their pocket, you had to work hard to determine whether the property in question was located in a special flood hazard area or if it wasn’t in a floodplain at all.

With the Internet, agents can use the same flood zone determination tools as lenders and this helped ease the burden on agents to figure out what the flood rate projection really would be.

Today, agents and homeowners can go online, enter a property address, a few other characteristics, and quickly generate a fair estimate of what their flood insurance rate will be. This makes a world of difference for agents looking to close a sale and in helping Americans get the flood insurance coverage they need online.

3. The Year Super Storm Sandy Exposed the Need for Better Preparation Before the Next Flooding Event

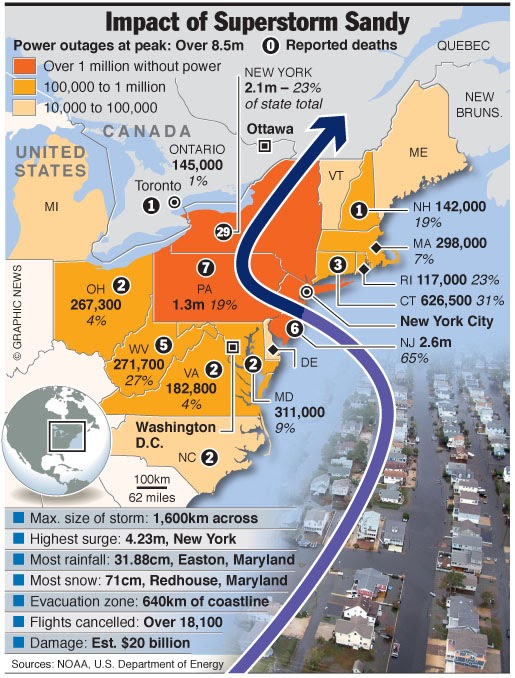

After Super Storm Sandy hit in 2012, we saw about 130,000 claims filed under NFIP – it was more than we’d ever seen before. The geographic range was huge – from Rhode Island down to the Carolinas.

October 31, 2012 — Superstorm Sandy may cause as much as $20 billion in economic damage and losses as the biggest Atlantic storm leaves millions of people without power, floods homes, disrupts millions of fliers, and forces businesses to close. Graphic shows impact of Hurricane Sandy in numbers.

Many of the people whose properties suffered flood damage had never experienced a flood before, and too many of those who did have flood insurance coverage realized they didn’t understand what it could do to help them recover.

The resources we had at the state and national levels to respond to the storm were stretched thin, and after Sandy, it took longer than it needed to and to get them back on their feet again. That’s when the conversation shifted to how we can better plan responses to large scale disaster events.

At National Flood Services, we do multiple exercises a year in mock events so that we can test all of the resources that we’ve aligned to these events, internal or external, should we need to respond to an event of that size.

FEMA became highly aware of the customer journey after Sandy, which encompasses everything from the purchase of the policy through to when a homeowner might experience a claim. Since then, they’ve done a lot of work to document that journey, identify opportunities for improvement, and continually consider what that journey may be like after the next storm.

We Can Still Do More to Educate Homeowners

I’m still surprised by the lack of understanding of the coverage that the policy provides. I’d love to see fewer flood insurance policyholders surprised by exclusions or restrictions after a storm hits their property.

When it comes to flood risk, I’d love for consumers to understand that they need to do more than research how to prepare for the next hurricane season if they’re living on the Gulf Coast. Thanks to climate change, the risks of inland flooding are higher than ever, but many Americans still don’t have the coverage they need as the number of flood events increases annually.

We’ve learned so much and seen so many advances in the technology available to agents and underwriters, but we still have ground to gain in providing the right, accessible education for property owners.

If you’re curious to see what the experience is like, get a quote on your property today.

Blog Articles