Help Americans Find the Flood

Insurance Coverage They Need – Online

On November 11th, Hurricane Theta pushed 2020 over the line, making this the most active hurricane season on record. Thanks in part to this year’s parade of storms, Americans are waking up to the fact that the changing climate is worsening hurricane seasons in the Atlantic, and many Americans in the middle of the country are beginning to see the impacts of this increased rainfall.

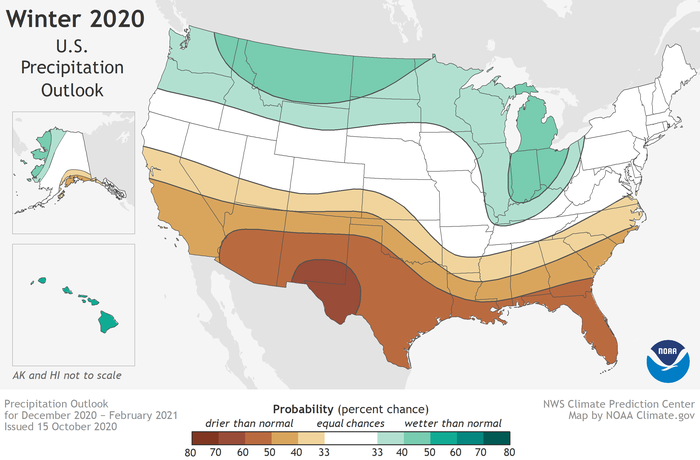

Although there will continue to be a drought in much of the southwest this winter, NOAA’s October forecast for the winter predicts that many in the northern states are headed for heavier-than-usual rainfall in the months ahead.

But it’s not just this year that’s forecast to be soggy: climate change and shifting rainfall patterns will continue to put both coastal and inland communities across the country at greater risk of destructive flooding in the coming years.

Unfortunately, Americans’ understanding of flood insurance hasn’t caught up to these changing realities: a recent survey we conducted with The Harris Poll found that only 12 percent of Americans have flood insurance and a staggering 74 percent are under the mistaken impression that they don’t need it.

Here’s a closer look at our findings and why they signal an important opportunity for agents to serve as advisors who can help prepare their customers and communities for the dangers floods present.

Most Americans Aren’t Comfortable Buying a Flood Insurance Policy Online Yet

A 2020 study by JD Power found that 90 percent of Americans are open to purchasing auto insurance online. Deloitte research shows that more than 90 percent of life and annuity insurance customers handle at least part of the purchase process online.

In contrast, our survey found that 80 percent of Americans would not buy a flood insurance policy online.

Why not? For nearly half of this group, it’s because they think they don’t need flood insurance coverage. Another 26 percent noted that they’d prefer to make the purchase with help from an insurance agent.

In a separate question, 75 percent of respondents agreed that, regardless of where or how they purchased a flood insurance policy, they’d want to work with an agent to do so.

This represents a huge opportunity for insurance agents to do two things:

- Educate Americans about their exposure to flood damage and how flood insurance can help protect their biggest asset.

- Guide them through the process of buying flood insurance.

This is particularly compelling at a time when more and more insurance purchase behavior is moving online. Let’s take a look at how you can embrace this opportunity to both better serve their customers and grow your books.

How Agents Can Become a Trusted Flood Insurance Resource

The opportunity for insurance agents is clear, but it also presents important questions:

- How can agents become trusted flood insurance advisors if they themselves aren’t familiar with the ins and outs of flood insurance coverage?

- How can agents reach customers who may not know they need this policy – and may not otherwise make contact with an insurance agent?

Luckily, the answers are fairly straightforward.

First, to become familiar with how flood insurance policies work and how to guide customers through the process of finding and buying the right policy, agents can tap into NFS resources designed exactly for this purpose:

- Our educational video library includes easily digestible videos to help agents understand flood basics as well as longer videos that offer in-depth breakdowns of more complex topics.

- Our sales toolkit includes tools and tips from experts that clarify the sales process for agents, whether they’re brand-new to flood sales or looking to improve their current strategy.

As for connecting with customers who may not know they need flood insurance coverage, it’s as easy as starting with existing customers. Agents can help customers understand their flood risk and find policies that match their needs.

Stats to Help Frame a Conversation about the Value of Flood Insurance Coverage Today

Our survey found that 51 percent of Americans don’t know what they’d do if they experienced a flood, and without this understanding of what can be done in the wake of this type of property damage, it’s tough to explain how important it is to hold a flood insurance policy before the water arrives.

One key part of this conversation is making sure customers understand the value of the protection they’re getting, relative to the potential cost of flood damage. Two key figures that can help here:

- A single inch of floodwater causes an average of $25,000 in damage.

- The average flood insurance claim is more than $40,000.

After ensuring that a customer is protected and has peace of mind about their flood exposure, agents can open up the conversation, asking whether their neighbors are aware of the area flood risks, for example.

Given the numbers our survey revealed, conversations like this amount to an act of service agents can do for their community: by helping customers understand the flood risks they face and giving them the guidance they want to mitigate those risks, agents improve the resilience of the entire community while also growing their book.

Americans Need Help Understanding Their Flood Risk

Many Americans believe three dangerous myths about floods: that they’re rare, that flood risk is fixed, and that only massive floods cause serious damage. These misconceptions can lead to a false sense of security with devastating consequences, perhaps especially in the event of inland flooding.

Agents have the opportunity and tools to help customers recover from flood-related disasters in their communities by making sure property owners have a flood policy. By arming themselves with key flood knowledge and relying on the strength of an insurance platform like ours, agents can become trusted advisors and guides who help their communities prepare for floods and emerge stronger than ever.

Blog Articles