Our 5 point plan for

your insureds

By failing to prepare, you are preparing to fail.

NFS follows Benjamin Franklin’s lead in guiding our claims solution. As we enter an unprecedented flood season, NFS has made every preparation to deliver a fast and seamless claims experience for your insureds. Hurricanes can move quickly and unpredictably, and it is critical to have a claims partner who can respond in real-time to handle the most severe challenges Mother Nature can throw our way. This isn’t our first rodeo and we’ve delivered for FEMA and the country through the worst storms in history – Sandy, Katrina, Harvey amongst many others.

1. Rest assured. Your insureds are in safe hands

Our claims team:

35+ years of serving policyholders in times of crisis, as they face the emotional & financial costs of flooding.

Handled 60k+ claims during Hurricanes Harvey, Irma, and Maria

Paid out more than $5 billion on behalf of our clients and the NFIP during these storms.

Able to spin up new offices in hours and on board hundreds of new staff to handle the volume

Our efforts have paid off: today, we’re proud to have a Net Promoter Score of 62, one of the industry’s highest.

2. We are committed to educating and guiding agents and claimants through through the claims process

Check out the resources below to ensure you and your insureds are ready in event of a loss.

3. Even in the most severe storms, NFS will be ready to respond

Central to our ability to deliver an industry-leading claims experience is our CAT planning approach. We go into hurricane season having modeled out and tested every scenario. Literally. We conduct dry-runs before the season starts that involve the whole company.

And our bench is deep – every function has 3 levels of back-up ready to step in.

In addition, we:

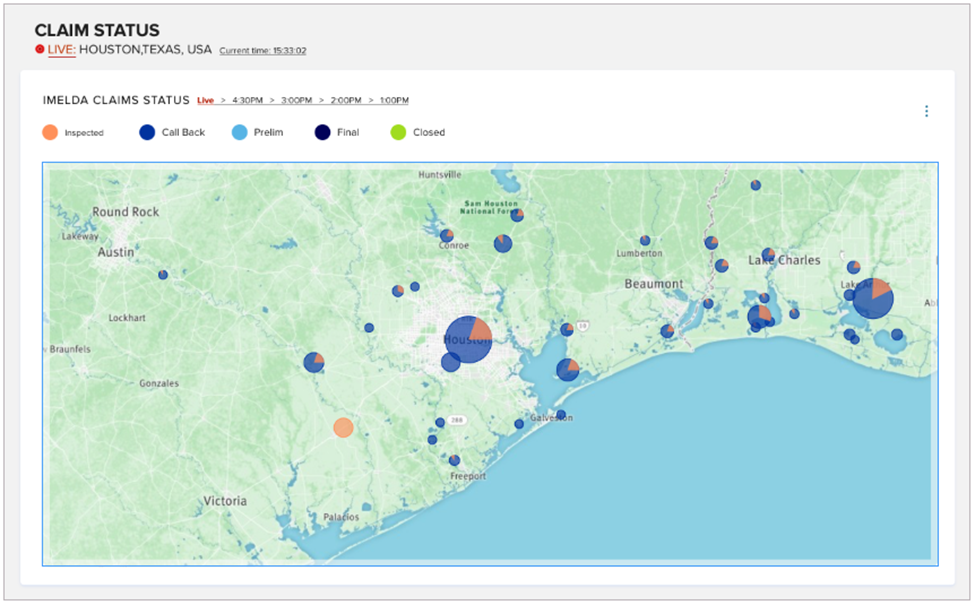

- Monitor every storm nationwide

- Have sophisticated predictive analytics showing potential exposure

- Have Surge support teams that can ramp to handle any claims volume that may arise.

As a CAT event approaches a medium probability of becoming a tropical storm, hurricane or major rain event, we begin monitoring the forecasts 24/7 and ready our teams to implement our CAT Plan.

We review historical events and analytics to forecast surge requirements. Combined, our teams can provide up to 3,500 experienced flood insurance experts, which ensures coverage in the case of simultaneous events spread across multiple locations.

Key aspects of our CAT plan:

- Dry-runs

- Sophisticated surge modeling

- Surge play-books

- Weather pattern monitoring and analytics

- Long-standing and strategic relationships with IA firms

When Hurricane Harvey made landfall in Texas and Louisiana in 2017, we executed our pre-negotiated agreements with vendors to ramp up 350+ trained claims professionals and leaders to handle the workload. On one of our busiest days handling claims during this event, our Claims personnel (NFS and IA firms) received and processed 3,900 First Notice of Loss (FNOL) claims calls from policyholder survivors filing claims.

4. We are innovating so your insureds will have the best experience

And we don’t stop there. We are continuously innovating to find ways to simplify the claims experience, shorten the times to complete the claims cycle for policyholders and ensure we are always ready to respond.

We are currently partnering with FEMA to look at ways to simplify the adjusting process and innovating with social media to identify early signals of flood risks. All with the objective of making the claims process as seamless as possible.

5. We’re committed to delivering the best claims experience

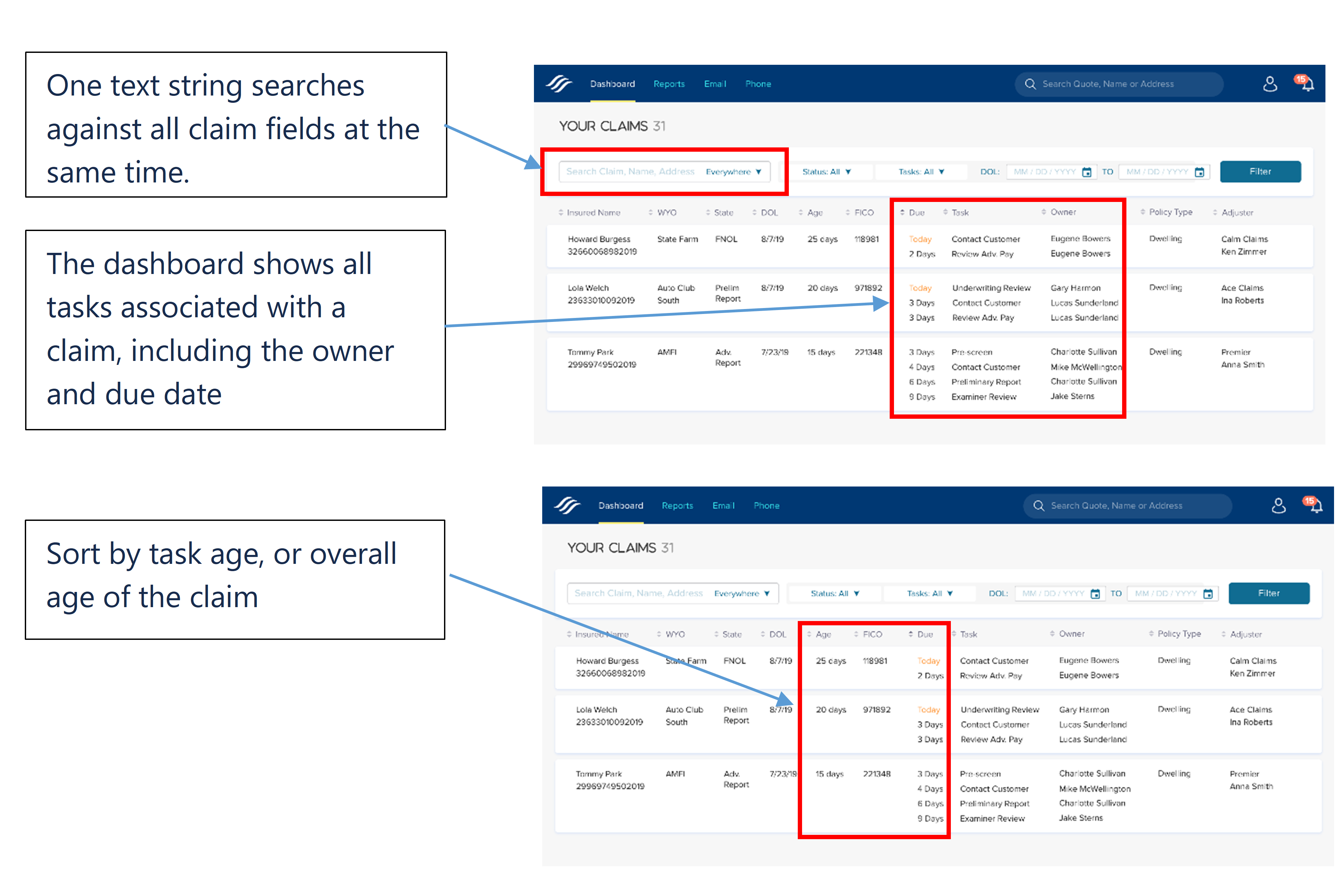

We complement the best flood CAT expertise in the country with a powerful technology solution that makes the process simple for your insureds and keeps you in the loop every step of the way. Trident Claims helps flood survivors recover faster by aiming to shorten the average claim life cycle from 29 days to 15 days while also reducing errors and improving the customer experience.

Notable features include:

- Simple FNOL submission

- Automatic adjuster assignment

- Automated updates to agents and policy-holders

- Modern and simple estimate views

And stay tuned as we plan more releases such as a new mobile app for policyholders.

An example of the new ease of use with Trident

Blog Articles