Risk Rating 2.0 is coming October 1, 2021

Now is the time to sell flood insurance!

Beginning October 2021, FEMA is transforming the way flood risk is communicated by introducing Risk Rating 2.0 (RR 2.0). This new methodology is designed to help communities and their citizens to make better-informed decisions when it comes to evaluating flood risk and purchasing flood insurance.

Reach out to your policyholders & explain

the importance of purchasing a flood policy today!

Keep scrolling to:

- Learn about our Risk Rating 2.0 resource center

- Download our customizable agent marketing templates

Sell more flood insurance in the coming months with

our simple playbook.

Over the last few years, FEMA has been working to update the National Flood Insurance Program’s (NFIP) risk rating methodology. The new methodology, Risk Rating 2.0, will harness the power of new technology and insurance industry best practices that will result in a policy rating that better reflects a property’s unique flood risk.

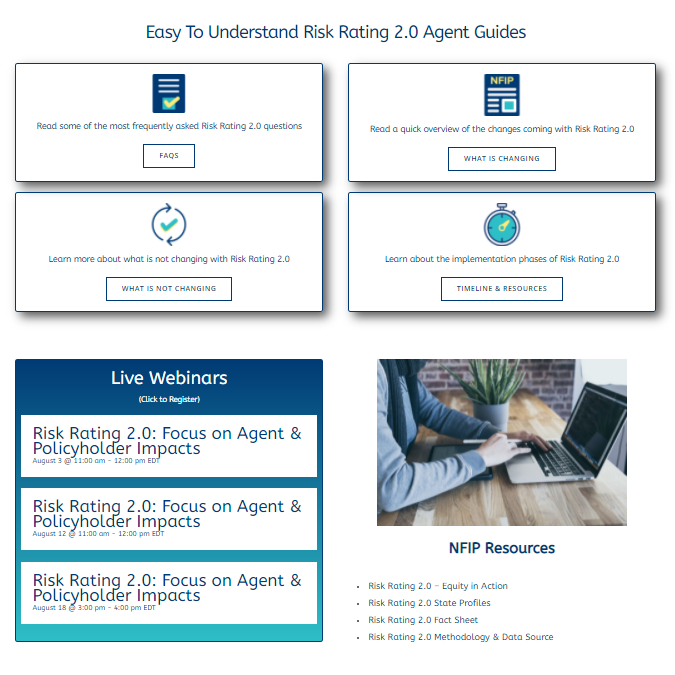

We know that changes like this can create uncertainty for both agents and policyholders alike. To help, NFS has got you covered with multiple options like:

- User Guides

- Live Webinars

- Interactive Modules

Resources:

Page Last Updated: July 29, 2021