When Rising Seas Sink the 30-Year Mortgage

Here in the autumn of 2020, low interest rates and a hot housing market may make it look like the American mortgage industry is robust. But as homeowners on the coasts will tell you, the homeownership landscape is rapidly changing, and they don’t just mean the wildfires that are reshaping their hillsides.

The 30-year standard for mortgages in this country is rooted in the Depression, when this timeline created a useful benchmark that homebuyers could use to plan out their payments over a long period of time. It was intended to make homeownership management and affordable. But this long schedule of payments may no longer align with the changing climate’s timeline.

Climate change is transforming the classic 30-year home loan, particularly along the coasts, and the way homeowners and banks approach 30-year mortgages is changing in high-risk areas too. This behavior raises an important question: How practical is this lending model in the face of climate change? Let’s dig in.

How Coastal Homeowners Are Already Confronting Sea Rise Today

Between 1960 and 2015, the EPA reports that the relative sea-level rose more than eight inches in the Mid-Atlantic and parts of the Gulf Coast. And this trend is accelerating.

Homeowners in California, the Gulf Coast, and across the Eastern Seaboard have to contend with climate change on a regular basis, but few communities have seen the sea rise as rapidly as those in southern California. In the last century, the sea rose less than 9 inches in California, but by the end of this century, that rise is projected to be greater than nine feet.

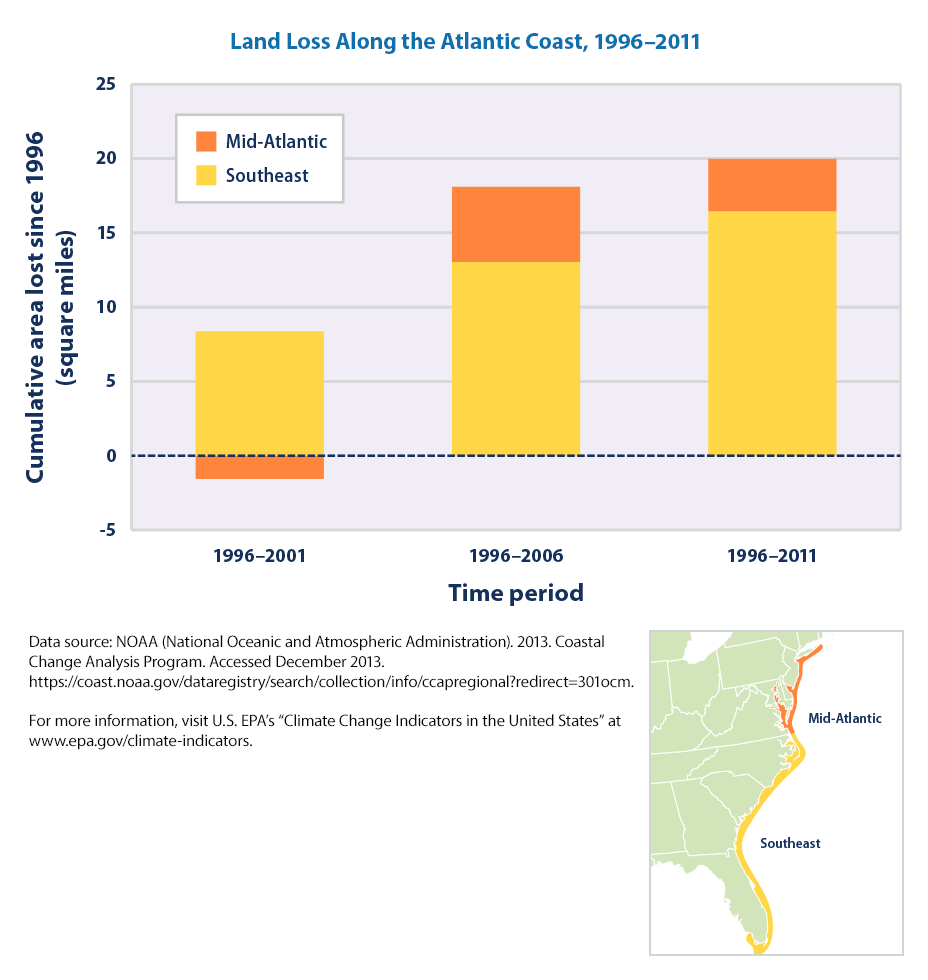

This kind of rapid land loss is already happening along the Atlantic Coast today:

But of course, the other way to talk about “land loss” is to call it what it is: ocean waters are rising. If you’re not sure what flood risk looks like in your area, you’re not alone. Americans tend to underestimate their exposure to flood risk.

To ensure you’re prepared for flooding in your area, talk to your agent about your flood risk today.

Growing Borrower Trends Reflect a Shift in Lender Awareness

As Freddie Mac’s former chief economist Sean Beckettii told the New York Times in 2016, “Losses from flooding both inland and along the coasts are likely to be greater in total than those experienced in the housing crisis and the Great Recession.”

This is no longer a secret. Earlier this year, the New York Times reported that “home buyers are increasingly using mortgages that make it easier for them to stop making their monthly payments and walk away from the loan if the home floods or becomes unsellable or unlivable.”

The public – inside bank offices and in their homes – is increasingly aware of the risks coastal homeowners face, and expert analysis back this up. A recent paper in Climatic Change uncovered three important insights:

- Lenders selling off coastal mortgages the fastest are smaller local banks, which are more likely than large national banks to know which neighborhoods face the greatest climate risk. According to the author Dr. Jesse Keenan, “They have their ears to the ground.”

- Local banks sold off about the same number of mortgages in vulnerable zones as in other areas. But in vulnerable areas, that 43 percent jumped nearly a third to 57 percent by 2017.

- In several counties exposed to rising seas, a growing number of mortgages required down payments between 21 percent and 40 percent.

That smaller lenders are increasingly selling these high risk mortgages to government-backed buyers like Fannie Mae isn’t a sign of greed – it’s a sign that lenders are wising up to the risk they’re taking in lending to customers buying coastal property.

A Better Response to Sea Rise: Could Flood Disclosures Be the Answer?

Sea walls and managed retreat won’t change the fact that people continue to rebuild faster in flood-prone areas.

While it’s true that in Special Flood Hazard Areas, flood insurance is required today, proper insurance may not be the only solution – although it certainly is part of any flood risk mitigation effort.

Rather than following the model of earthquake insurance, some have suggested that mandatory

flood disclosures would be a powerful way to ensure that prospective homebuyers understand the risks they’re taking on before they sign their next 30-year mortgage.

But disclosures can also be a powerful way to ensure that homebuyers know what risks they’re taking on before they sign their mortgage. With the help of recently redrawn flood maps, the imminent arrival of Risk Rating 2.0, and signs that new technology is already helping homeowners and lenders get a better picture of flood risk, there is reason to be optimistic.

With right information and modern flood risk assessment tools, it’s possible for homeowners to acquire appropriate flood insurance to support their next long-term real estate investment.

With or without a 30-Year Mortgage Model, Waters Are Rising

As we get a better picture of the true risks of coastal and inland flooding with new flood maps and improved data, homeowners can better prepare for the unexpected.

For homeowners in high risk coastal areas, the big question may seem to be whether to adapt to climate change or buy elsewhere. But as many homeowners in the Midwest would attest, leaving the coasts doesn’t eliminate your risk of flooding, as inland flooding is increasingly common across the country.

The best step you can take today is to know how much risk you’re taking on and make sure you have the insurance to protect your home. Contact your agent to get started.

Blog Articles