To Expand Your Risk Mitigation Toolkit,

Raise Your Local Disaster Awareness

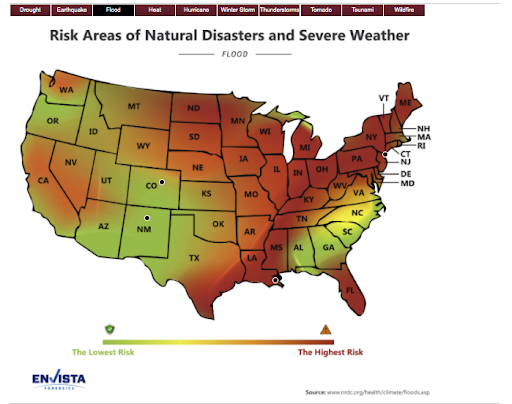

Ninety percent of natural disasters in the U.S. involve flooding, and the majority of Americans are underprepared for this event. But flood protection is just one piece of the risk mitigation puzzle for homeowners.

For example, droughts typically precede wildfires, and flooding and mudflows often follow. In many parts of the country, property owners need to be prepared (and insured) for a roster of interrelated disasters.

And the need for heightened risk awareness is urgent. The cost of disasters in the U.S. nearly doubled year-over-year to $95 billion in damage in 2020, and the pace at which our climate is changing only seems to be accelerating.

So, what’s a homeowner to do? The best approach is to stay informed and insured to the best of your ability.

Get to Know Your Local Disaster Profile

While certified insurance agents are equipped to discuss your home’s flood risk, homeowners shouldn’t stop there in the quest for a better understanding of their home’s disaster profile.

The National Center for Disaster Preparedness (NCDP) at the Columbia University Earth Institute invites guests to “Explore natural hazards in your community.” And it’s not a bad idea, given the variety of natural disasters that frequent North America. The NCDP ranks counties by risk level for the following hazards:

- Avalanche

- Drought

- Earthquake

- Flood

- Heatwave

- Hurricane

- Landslide

- Snowfall

- Tornado

- Volcano

- Wildfire

While you likely already know your local risk of volcanic activity, there are less obvious limits to this county-level information. Disaster risk may vary greatly by neighborhood within each county, and homeowners will have to dig deeper into local historical records to understand where past events have impacted residents.

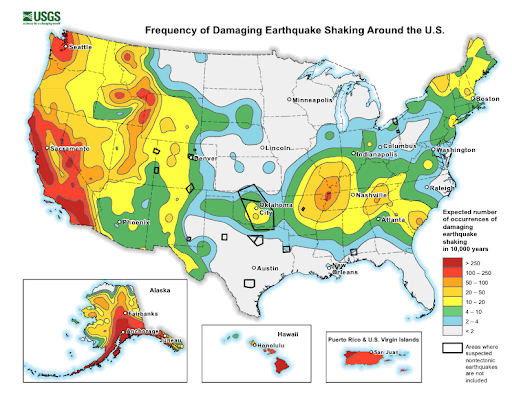

There are other fantastic resources out there that allow you to sort by disaster, like the USGS’s National Seismic Hazard Maps, but for those looking for a more comprehensive, high level look at their local risks, Envista Forensics’s high risk maps are a fine place to start. While this data dates back to 2015, it may help you understand the baseline of risk in your area by type of natural disaster.

Your Risk Levels Are Constantly Evolving: The Example of Flood Risk

The consequences of climate change aren’t just related to stronger storms and rising sea levels. While hurricanes and typhoons get a lot of attention in the news, these storms are not the primary causes of flooding across the U.S., as homeowners living near the banks of the Mississippi and Missouri Rivers well know.

Far from the coasts and the nearest body of water, American homeowners are finding that climate change is bringing costly basement flooding and increasing winter flood risks thanks to early snowmelt and ice jams miles away.

As awareness of the threat of inland flooding grows, American homeowners are also becoming aware of the challenges of getting an accurate flood map and a complete picture of your flood risk. As the climate continues to change, homeowners should evaluate their local flood risk on a regular basis – perhaps annually – or following any local disaster.

If you don’t yet have flood insurance for your property, reach out to your agent to get a quote today.

How to Prepare for Earth Movement

When it comes to some types of disasters, like earthquakes and landslides, there are limits to what you can do to prepare. Ready.gov is a fantastic resource for those who live in areas where landslides have happened in the past, but as their experts state, you can’t assume that the next debris flow or earthquake will happen in the same location as the last one.

When it comes to mudflows and landslides, some homeowners will be more vulnerable than others based on local geography. For those living near cliffs, at the base of a slope, or in other vulnerable areas, there isn’t much you can do once the structure has built. Long-term mitigation strategies like appropriate landscaping to support the slope around your structures may be a viable option, but it’s best to consult a local expert.

Like earthquakes, landslides are typically classified as “earth movement,” which is not covered by most standard homeowners insurance policies. While you may want to invest in supplemental coverage to help you recover from a potential mud flow or other land movement, you should absolutely be familiar with local geologic conditions and seismic activity.

If this sounds like it’s outside your personal scope or curiosity, ask your insurance agent for help identifying certified professionals who may be able to assist you.

As Technology and Our Climate Evolves, Ongoing Risk Evaluation Is Getting Better

Technology isn’t just making flood management better, it’s also improving risk assessment that happens before waters rise. As insurers and homeowners await the arrival of Risk Rating 2.0, we can all take advantage of improvements in risk assessment tools.

As anyone living in California knows, improvements in local wildfire alert systems have become a critical piece of public safety infrastructure. Those in Tornado Alley have a great appreciation of advances in Doppler Radar.

Whatever your local risk profile, the best first step in expanding your risk mitigation toolkit is to ensure you’re up-to-date on local hazards. And when it comes to flood risks, the National Flood Insurance Program can help you get started.

Blog Articles